WHO WE ARE

About Certinia: Your partner in business success

Certinia offers premier cloud software solutions for services leaders looking to streamline business operations and enhance management efficiency. With Certinia, you connect the entire services lifecycle on one platform.

How we began

Founded in 2009 as a pioneer provider of Salesforce-native Professional Services Automation (PSA) and Enterprise Resource Planning (ERP) solutions.

At the core of our solution strategy is an unrelenting focus on the customer, helping businesses deliver excellence across the entire opportunity-to-renewal cycle—all on a single platform.

Why choose Certinia?

Your services business is complex. We believe managing it shouldn't be. With Certinia, you can connect your entire services lifecycle on one platform. Our Salesforce-native solutions help you unify operations and gain the real-time insights you need to overcome delivery challenges and drive success.

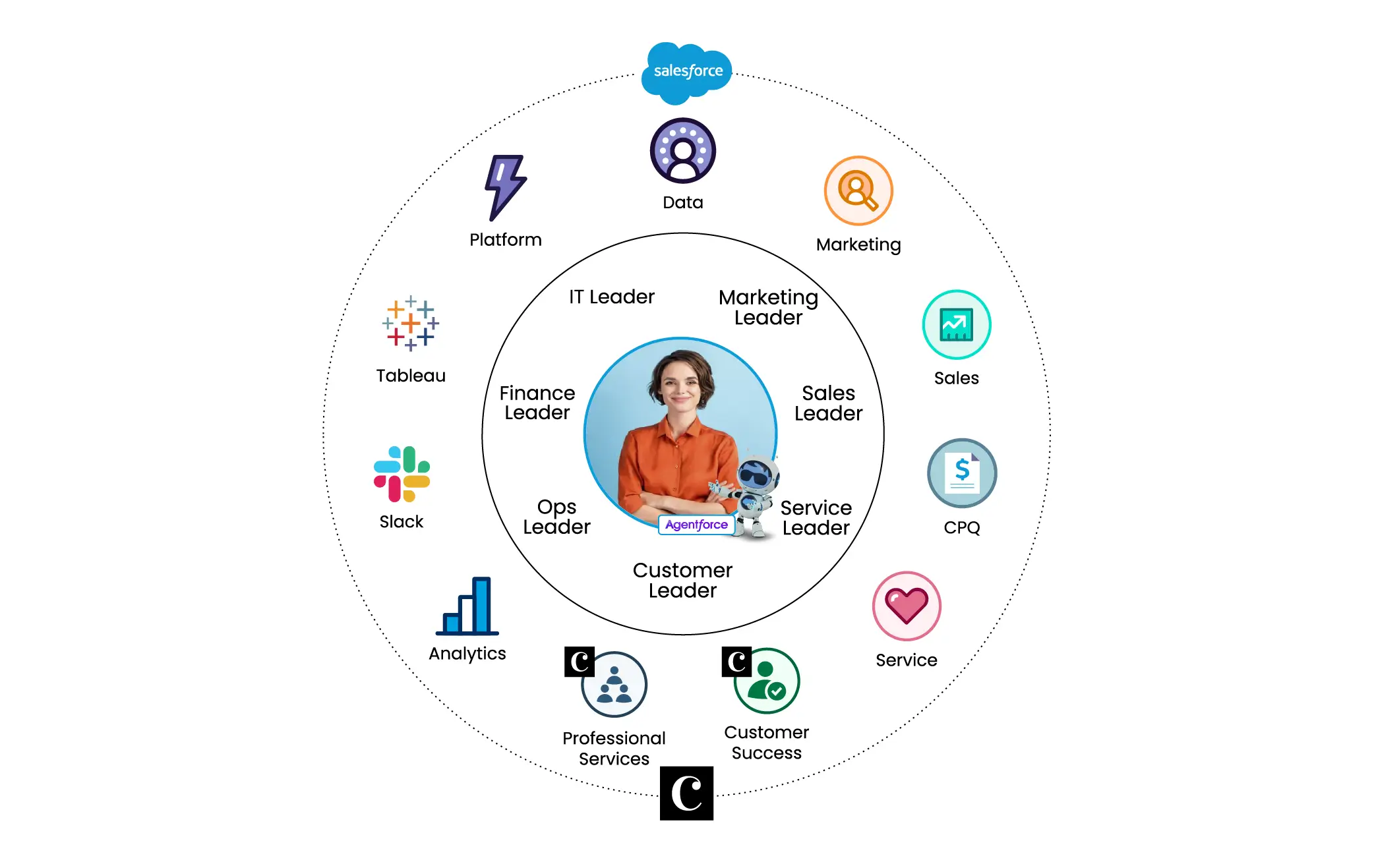

The connected services journey: Unrelenting customer focus

Today’s forward-thinking organizations are delivering a customer-focused strategy that integrates each step of the services journey seamlessly.

At the core of our solution strategy is an unrelenting focus on the customer, helping businesses deliver excellence across the entire opportunity-to-renewal cycle—all on a single platform.

Our Core Beliefs

7 principles for success in the services economy

Products are not people, people are not products.

People are not fungible, nor are they inherently or easily optimizable.

In an unpredictable world, variability breeds opportunity.

Those who can seize the new opportunities as they arise will increase their surface area for success.

Automate “work” and prioritize outcomes.

Automation that reduces the time, effort, and risk of tasks is valuable, but only insofar as it positively impacts measurable outcomes.

The customer is the center of the universe.

Products and services should always be built based on the expressed and validated needs of an identified customer audience.

Customer experience is how providers distinguish themselves.

An unrelenting commitment to ensuring positive customer experience is the difference between survival and extinction.

Elevate those who elevate others.

Some of the most powerful contributions in history have come from unsung heroes, whose work enabled their teams to change the world.

The “project” is the future.

The services-oriented modern economy is driven by the projects that empower the flexibility and innovation to adapt and evolve quickly.

Products are not people, people are not products.

People are not fungible, nor are they inherently or easily optimizable.

In an unpredictable world, variability breeds opportunity.

Those who can seize the new opportunities as they arise will increase their surface area for success.

Automate “work” and prioritize outcomes.

Automation that reduces the time, effort, and risk of tasks is valuable, but only insofar as it positively impacts measurable outcomes.

The customer is the center of the universe.

Products and services should always be built based on the expressed and validated needs of an identified customer audience.

Customer experience is how providers distinguish themselves.

An unrelenting commitment to ensuring positive customer experience is the difference between survival and extinction.

Elevate those who elevate others.

Some of the most powerful contributions in history have come from unsung heroes, whose work enabled their teams to change the world.

The “project” is the future.

The services-oriented modern economy is driven by the projects that empower the flexibility and innovation to adapt and evolve quickly.

The Salesforce-native Advantage

Certinia’s cloud solutions are built on Salesforce from the ground up, which removes the need for cumbersome, bolted-on implementations. Instead of warming up to new workflows, the whole organization enjoys the same easy-to-use interface while boosting delivery speed and quality. That means less time spent on deployment and more confident decisions. That's the Salesforce-native advantage.

Our cloud software solutions

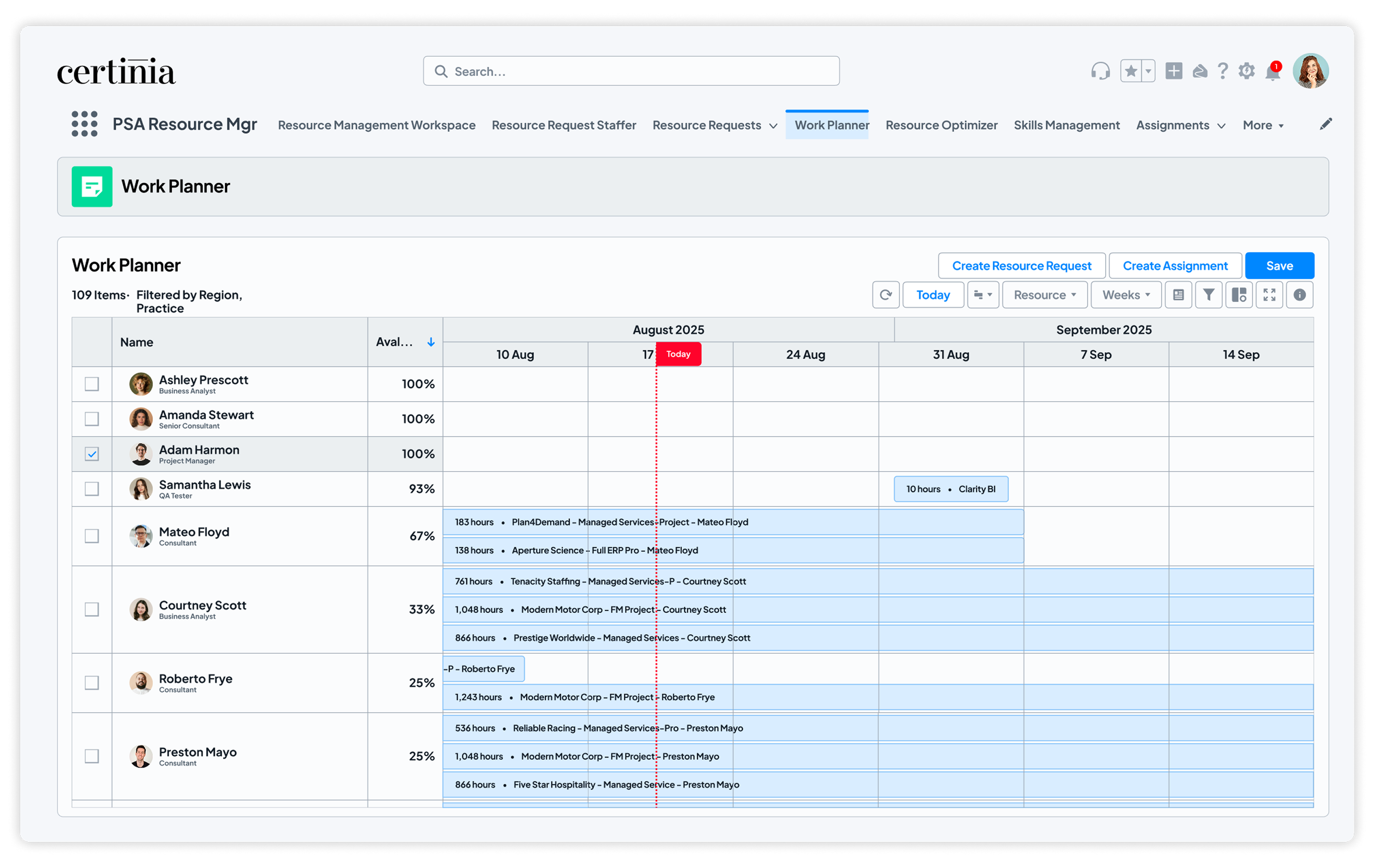

Professional Services Cloud

Manage resources, projects, and financials in the same application as your customer interactions. Get more visibility, predictability, and control across your entire services business.

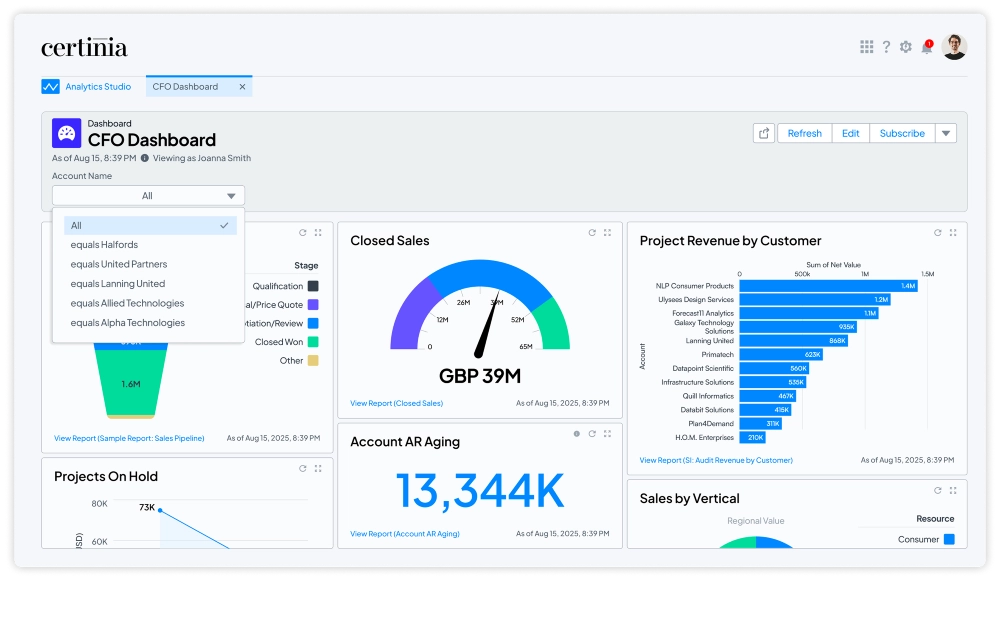

Financial Management Cloud

Streamline your opportunity to cash process, manage revenue precisely, and generate real-time financial analysis & audit trails with ease. Cloud software that puts your core financial management functions all on Salesforce.

Customer Success Cloud

Turn customer insights into predictable retention and growth. Gain a complete view of every customer’s journey to deliver successful engagements that drive lasting value.

Product awards and recognition

Certinia powers more than 1,400 customers in 30+ countries

“Simple tools cannot solve complex problems. But the sophistication of Certinia allows for solving complex problems. The reward at the end of that can be very powerful.”

- Tyler Flora

- Senior Director, Professional Services

Avalara

“Since deploying the Certinia platform, we've seen consistent increases in billable utilization and realized project margins enabling us to exceed our margin expansion targets while improving the quality of the services delivered to our clients.”

- Kurt Kuelz

- Vice President - Global Customer Outcomes

Siemens Digital Industries Software

“Certinia PS Cloud drives the highest levels of data quality across our professional services and higher levels of performance from our resources.”

- David Laffineuse

- Worldwide Director of Service Delivery

Thales

"Most customers don't want to worry about back-end systems, but they want them to be reliable, scalable, and they want their supporting partner to understand them."

- Mark Conklin

- Senior Director of Operations

Salesforce

“Certinia has been amazing for us—and if your CFO is saying that we made his life easier and he wants more—that’s all you need as a CIO.”

- Tony Sorensen, Vice President and Head of IT, Five9

Maximize your Salesforce investment with Certinia

See the impact Certinia + Salesforce could have on your services business.