Ten reasons why a single digital platform means growth for your business

See how Certinia PSA and ERP solutions

transform and optimize operations

Optimize resource utilization by managing your customers, teams, and projects in a single application.

Improve customer satisfaction and retention with a scalable approach to orchestrating success.

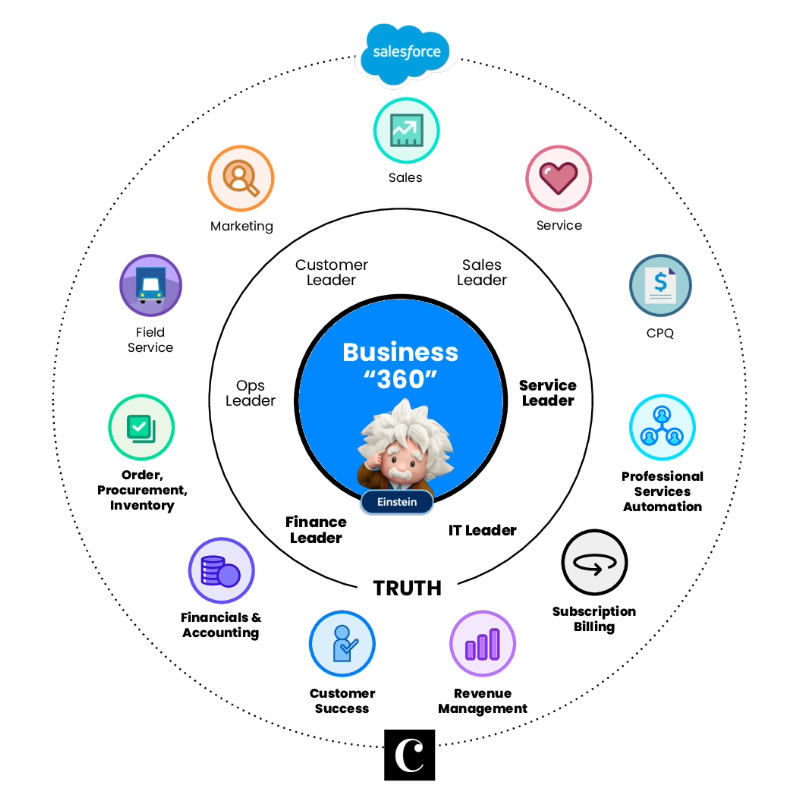

A single source of certainty

Certinia is native to Salesforce–sharing the same customer record, user experience, and industry leading analytics as the world’s most trusted cloud business platform. Empower your teams with real-time collaboration across your entire services business and deliver truly differentiated customer experiences.