Why you should run your ERP on the Salesforce Platform

We all know that Salesforce allows businesses to manage all their customer interactions. But as the platform has matured, it has become about more than just sales – businesses have been able to multiply the benefits they earn from the platform.

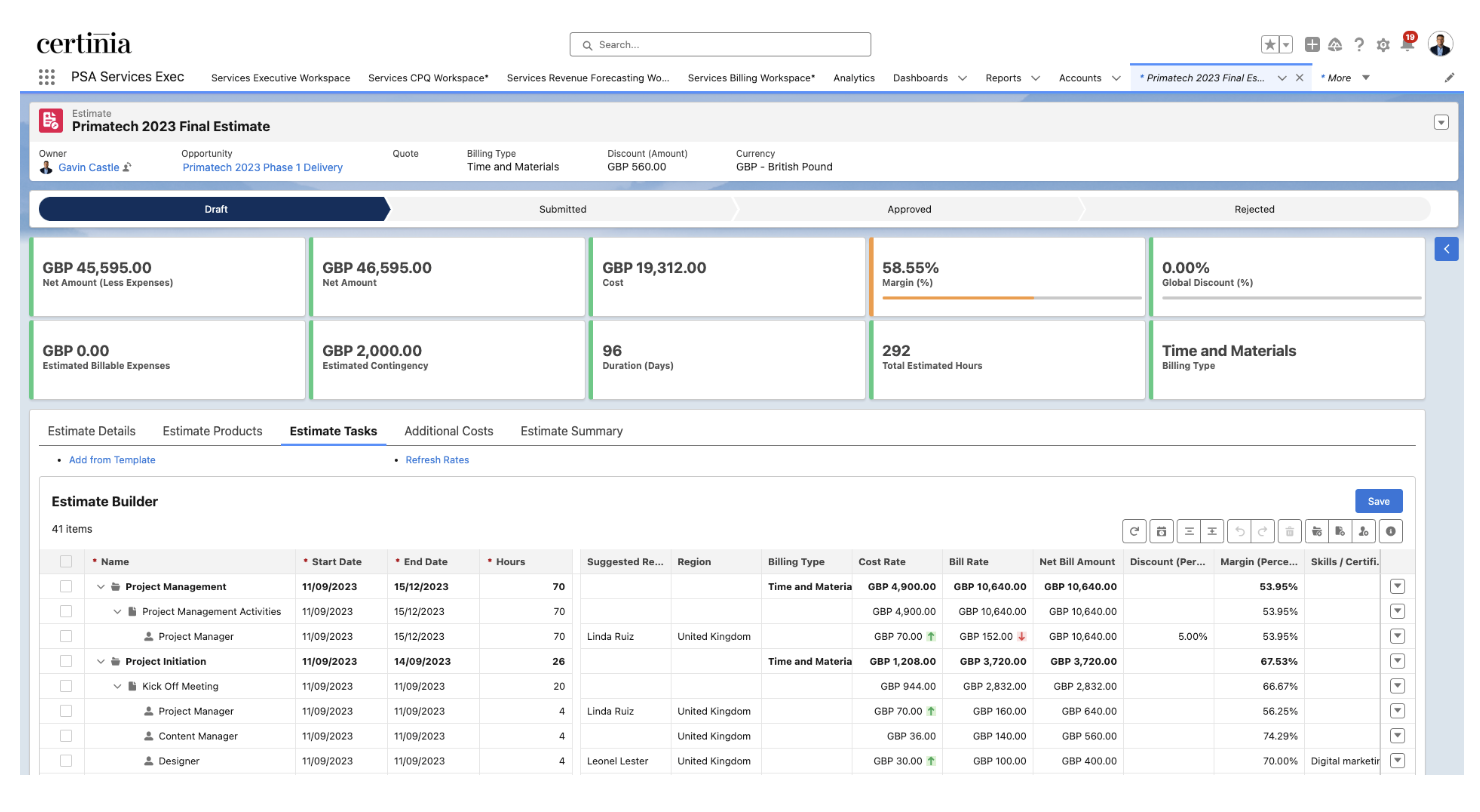

Accounting solutions and other ERP tools especially make a perfect fit – instead of hitting a wall when the deal closes, your customer data can continue on its path through service delivery and customer success, invoicing and billing, and revenue recognition and renewal.

Some businesses have tried to integrate old ERP or off-platform systems and Salesforce, but nothing is more effective than using an ERP solution built on the platform itself. Now let’s dive into the how and why.

4 key benefits of having a Salesforce-Native ERP

1. Master Customer Record

If sales and finance live in completely different worlds, it’s hard to coordinate and keep track of customer engagements.

Using an ERP system built on the Salesforce platform automatically puts sales and finance on the same team. From initial customer engagement through deal close, service delivery, and accounting, everyone has access to the exact same customer record.

Everyone gets the answers they need, everyone can serve the customer, and there are no more arguments about whose data is right.

2. Streamlined Finance

With their finances on a Salesforce-based ERP system, the finance team can enhance both invoicing and accounts receivable (AR) processes to generate huge savings.

Instead of wasting time with spreadsheets or manually keying in data into disparate systems, finance professionals have everything they need in one place including contract details, order confirmations, billing information, and more.

Everyone from the field to the back office gets the same, complete view of the customer, with no integrations, no errors, no delays, and no data duplication. As a result invoice disputes are reduced, days sales outstanding (DSO) improves, and cash flow is easier to manage.

3. Reporting

The use of powerful, built-in tools such as Salesforce CRM Analytics, give finance leaders both high-level insights as well as granular reporting into potential risk areas and business opportunities.

What could be more impactful than having all of your customer, operational and finance data in one place? It’s a goldmine of knowledge for executives and managers across the organization to make quick decisions and drive business growth.

It enables the drivers of revenue and costs to be managed, profitability to be optimized, and customer lifetime value truly understood.

4. Compliance

Accounting rules and requirements around revenue recognition (IFRS15 and ASC606) have become increasingly complex as companies embrace new revenue models such as SaaS models and usage-based contracts. This requires tools that can automatically recognise revenue directly from the source, including opportunities, orders, contracts, projects, and invoices.

Accounting may be more complex now, but CRM plus ERP makes it easier than ever before. In addition, having a consistent and reliable source of data means that the time and effort required to close the books at month end can also be significantly reduced.

register here!

How this benefits the whole organization

It’s not just the finance function that benefits from having their ERP systems on the same platform as everyone else. Those responsible for managing Salesforce realize three key benefits as well:

1. Technology

Because all the applications are built using the same technology platform, there is only one set of skills to learn, and there are no integrations to build or maintain between different systems. In addition, having a common security model and managing a shared global approvals engine (including policies, rules, and workflows) will enable a more controlled, robust, and auditable environment.

We all know the problems of trying to run a business on a ‘mish mash’ of random spreadsheets! The overall result will be a much lower total cost of ownership, with valuable IT resources able to focus on critical systems development work rather than ongoing maintenance.

2. User Experience

Having a consistent user experience, based on lightning, that is simple, engaging, and easy to use, will enhance user adoption and make systems training much easier. A common ‘look and feel’ is really impactful, especially when complemented by personalized dashboards specifically designed for the needs of particular roles.

Providing users with all the tools that they need to do their job through ‘one pane of glass’, means that they can focus on their work rather than having to worry about which systems they use for what.

3. The Salesforce Platform

As a company continues to grow, it is vital that the systems that the business relies upon can continue to scale.

Having a resilient and future proof platform, such as Salesforce, capable of handling ongoing business change, increasing business size and transaction volumes, is critical.

In addition, the whole Salesforce AppExchange ecosystem has a role to play. This global network of partners provides a broad portfolio of innovative and complementary solutions to ensure that the ever changing needs of the business can continue to be met as the organization evolves.

Final Thoughts

If you, or any of your finance colleagues, would like to understand more about how running your ERP systems on the platform could help your business, then why not see what Certinia can offer. Register now for our next ERP Cloud Product Demo on March 28th.

Recent Articles

Maximize your Salesforce investment with Certinia